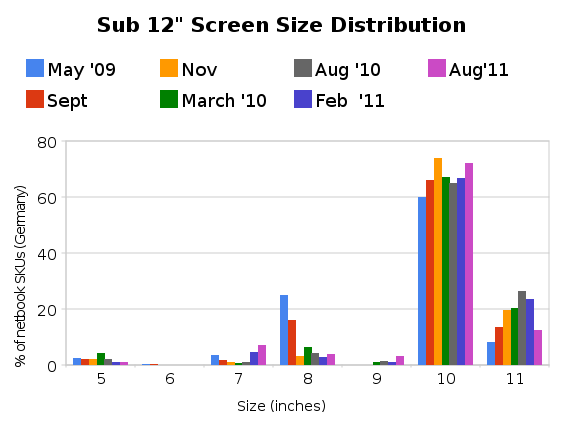

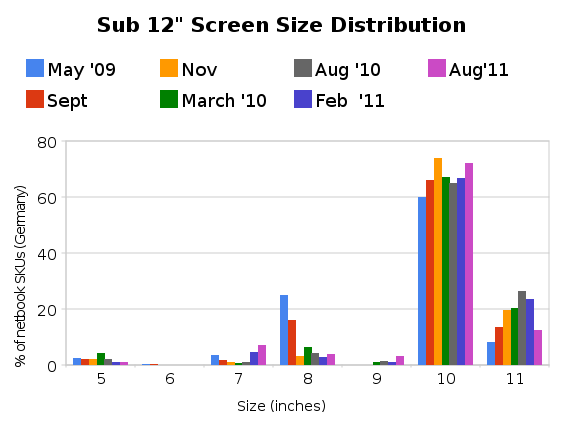

This is the seventh report on sizing trends in PCs below 12 inch screen size (and above 5 inch) appearing in the German market through the popular price comparison engine, Geizhals.at (*1) The last one was done in Feb 2011. Once again we’ve seen a big jump in overall numbers. The 7″ segment and 10″ segment have grown while the 11″ segment has shrunk. The 10″ market dominates more in this report than it did in the report of Feb 2011 although there is a clear trend occurring in the 7″ space where growth in products has occurred in all of the last 4 reports.

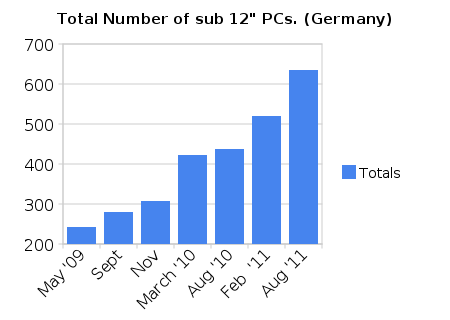

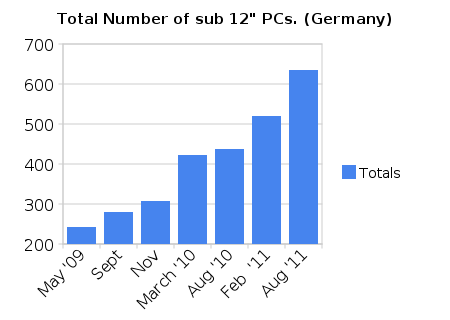

Number of SKUs in the market

The number of choices in the mobile screen space (above smartphones) has grown over 2x from approx 240 SKUs to over 630 SKUs.

Screen size distribution

The big jump in numbers is clear to see from the top graph. Total numbers jumped by 115 with most of that growth coming from the tablet form factor and the 10″ netbook/notebook sector. Big increases in the 7″ tablet sector (now the biggest number so far) and a reduction in the numbers of 11″ devices mean that percentage distribution has changed a lot. The iPad2 introduction caused the growth in the 9″ segment.

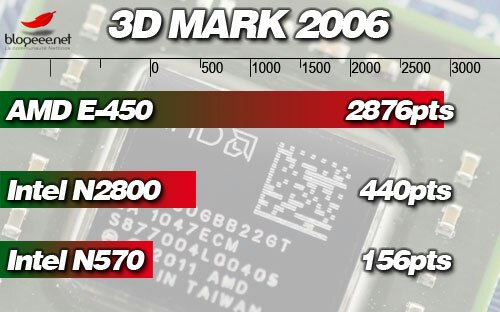

In the 10″ netbook space which accounts for 75% of the 10″ category there are now 18 AMD C-Series SKUs and 315 Atom SKUs. 64 of the Atom-based devices (20%) use the high-end N570 version.

In interesting statistic is that 1 in 5 devices on the market in the 5-11″ segment are from ASUS.

Across all categories, ARM-based CPU designs account for 23% of all devices, almost exclusively in the tablet sector. It will be interesting to see how that changes over the next 2 years with the introduction of Windows for the ARM processor.

In terms of weight, the tablets mean that the average weight of a device has gone down. 28% of the devices weigh under 1KG.

Meego appears for the first time along with the cheapest and lightest netbook ever launched. The ASUS Eee PC X101.

Chromebooks did not enter the sub 12″ screen space yet. (Acer 700 not available in Germany)

Sandy Bridge (2nd Generation Intel Core CPUs) enters the sector with 14 SKUs from 5 devices.

Total number of tablet form-factor devices: 193 (30% of total)

Cheapest devices:

- X86/Windows Laptop Eee PCR101D at 199 Euros. (Was: Samsung N145 at 228 Euro)

- Non-Windows Laptop (X86-CPU) – Eee PC X101 (Meego) at 169 Euros

- ARM Tablet Debitel One Pad (Android 1.5) at 59 Euro

- X86/Windows Tablet Archos 9 at 370 Euros (was 402 Euros)

In terms of netbook trends, the search and news volumes seem to be steady after their large drop in Q1 (see Google Trends.) Numbers of devices in the market have increased and obviously the introduction of Cedar Trail in Q4 will create news, products and searches in the netbook category. The trend for netbook products, news and search is going to be level-to-rising for Q4 That may, or may not, relate to sales numbers.

In terms of handheld PCs, our focus here at UMPCPortal, it’s a sad story. The online market is now almost totally clear of 5-9″ X86-based Windows devices. It will be interesting to see how the Windows 8 market affects this in 2012.

Warning: Please remember that this is a single data-source analysis of what is happenning today, in the German market. This is not a complete market analysis report. You may use the data and images but please also reference this article which includes this warning.

*1 Based on SKUs, not model families. Data taken from Geizhals An English language (and UK market) version of Geizhals is available at Skinflint.

CES 2013 is all over for another year. We weren’t there but thanks to live streams, press releases and news from other sites we were able to relay all the important news for you and had the time to add a little more analysis that we would have done had we been there.

CES 2013 is all over for another year. We weren’t there but thanks to live streams, press releases and news from other sites we were able to relay all the important news for you and had the time to add a little more analysis that we would have done had we been there.