Apparently not content with being one-upped by its smaller sibling, the HP Envy 6 Ultrabook is now showing its face (and price tag) on HP’s Australian website. We’ve unfortunately confirmed a large (15.6″) but low resolution 1366×768 screen, and there seems to be an indication that the Envy 6 is lacking the discrete GPU that has been confirmed in the Envy 4, though we’re keeping our fingers crossed that this is incorrect!

Apparently not content with being one-upped by its smaller sibling, the HP Envy 6 Ultrabook is now showing its face (and price tag) on HP’s Australian website. We’ve unfortunately confirmed a large (15.6″) but low resolution 1366×768 screen, and there seems to be an indication that the Envy 6 is lacking the discrete GPU that has been confirmed in the Envy 4, though we’re keeping our fingers crossed that this is incorrect!

Tag Archive | "hp"

HP Envy 6 Pops Up on Australian Site, Reveals a Low Resolution Screen — Missing Discrete AMD Graphics?

Posted on 04 May 2012

New HP Envy 4 Ultrabook Appears on HP’s Chinese Site, Specs and Pricing Revealed

Posted on 04 May 2012

The HP Envy 4 and Envy 6 are two new Ultrabook additions to the Envy series and it looks like they’ll be available for purchase soon. We were able to confirm initial leaked reports of the HP Envy 4 and Envy 6 last week by tracking down some leaked official documentation, and just recently the Envy 4 has sprung up for sale on HP’s Chinese site, giving us an indication of price and a confirmation of the leaked specs.

The HP Envy 4 and Envy 6 are two new Ultrabook additions to the Envy series and it looks like they’ll be available for purchase soon. We were able to confirm initial leaked reports of the HP Envy 4 and Envy 6 last week by tracking down some leaked official documentation, and just recently the Envy 4 has sprung up for sale on HP’s Chinese site, giving us an indication of price and a confirmation of the leaked specs.

Confirmed: New HP Envy 4 and Envy 6 Ultrabooks Leaked

Posted on 24 April 2012

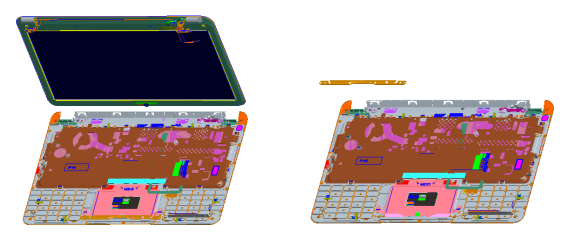

It hasn’t been long since HP officially launched the HP Folio 13 Ultrabook and the Envy Spectre 14 Ultrabook, but it seems that they’re already working on successors so these devices. Uncovered in a thread over at NotebookReview forum was some internal HP communiqué indicating two new additions to HP’s ‘EVNY’ line, the Envy 4, and Envy 6. Evidence thus far suggests that these two new models will be Ultrabooks, likely using the current-generation Sandy Bridge platform along with discrete graphics from AMD. Read the full story

It hasn’t been long since HP officially launched the HP Folio 13 Ultrabook and the Envy Spectre 14 Ultrabook, but it seems that they’re already working on successors so these devices. Uncovered in a thread over at NotebookReview forum was some internal HP communiqué indicating two new additions to HP’s ‘EVNY’ line, the Envy 4, and Envy 6. Evidence thus far suggests that these two new models will be Ultrabooks, likely using the current-generation Sandy Bridge platform along with discrete graphics from AMD. Read the full story

11 Companies with Ultrabooks This Christmas, Including Sony

Posted on 20 October 2011

In a Fox News TV segment (embedded below) the Ultrabook gets a very important airing with Intel CEO Paul Otellini along with commentary that made me sit up and listen. In–line with an interview we did early in September [5 more Ultrabooks coming], Paul says that there will be 11 companies offering Ultrabooks this Christmas, including Sony.

In a Fox News TV segment (embedded below) the Ultrabook gets a very important airing with Intel CEO Paul Otellini along with commentary that made me sit up and listen. In–line with an interview we did early in September [5 more Ultrabooks coming], Paul says that there will be 11 companies offering Ultrabooks this Christmas, including Sony.

OK, Let’s count them. We’ve got Acer, Asus, Lenovo and Toshiba on board already. We believe that HP will have an offering in 2011 too. Add the revelation that Sony will offer a solution and you’re left with 4 missing from the list. Let’s assume Intel are pushing the boundaries out to include the Samsung Series 9 and the LG Xnote. Where are the other two coming from? Choose from MSI, Gigabyte (we believe that’s a 2012 product) , Fujitsu, Dell (also believed to be a 2012 product), Packard Bell and possibly some re-brands.

Paul went on to say that there were 60 designs in the pipeline that will launch with Ivy Bridge. That’s something to look forward to in Q2/Q3 2012 but surely he means SKUs. I can’t see 60 different designs being launched. If they are we’re going to nee help with the Ultrabook database!

Intel Confirms HP Ultrabook in Q4

Posted on 04 October 2011

We’ve seen an HP Ultrabook ad and have some Digitmes rumors thrown in for good measure but I think this is the first time anyone with any authority has confirmed that HP will bring an Ultrabook to market.

We’ve seen an HP Ultrabook ad and have some Digitmes rumors thrown in for good measure but I think this is the first time anyone with any authority has confirmed that HP will bring an Ultrabook to market.

It’s Intel that have spilled the beans on what could be the definitive number of Ultrabooks launching in 2011. Intel Taiwan’s country manager Jason Chen said that Ultrabooks would be launching from Asus, Acer, HP, Lenovo and Toshiba. Looks like the South Korean LG Xnote P220 isn’t an Ultrabook in competing Taiwan !

The report comes from Taipei Times and also contains information about the Acer S3 local pricing and an estimate of Ultrabook volumes buy contract manufacturers Wistron.

HP Advertising ‘Ultrabook Computers’ – Next in Line to Launch?

Posted on 20 September 2011

This could be seen as an anti-Ultrabook stance (trying to sell standard PCs against the Ultrabook keyword) or preparation for an Ultrabook launch. HP are advertising against searches for ‘Ultrabook’

It looks pro-Ultrabook to me!

What HP’s Earnings Call Could Mean for Mobile

Posted on 23 August 2011

Last Thursday afternoon, the mobile and PC world was (moderately) shocked by Hewlett-Packard’s announcement that they were considering “all strategic options” for contending with the negative impact the HP Personal Systems Group (PSG) was having on the corporation’s total valuation. Key in this consideration will be the eventual fate of WebOS, the mobile OS that was brought in-house with the purchase of Palm in 2010.

Last Thursday afternoon, the mobile and PC world was (moderately) shocked by Hewlett-Packard’s announcement that they were considering “all strategic options” for contending with the negative impact the HP Personal Systems Group (PSG) was having on the corporation’s total valuation. Key in this consideration will be the eventual fate of WebOS, the mobile OS that was brought in-house with the purchase of Palm in 2010.

We can understand a certain amount of confusion with the tech-following public as to what HP is really doing and what they committed to on the earnings call. The amount of speculation that I saw running rampant around the web on Thursday was pretty daunting for anyone trying to get the picture on what was really going on. I sat in on the earnings call and wanted to post a few notes on my own take-aways. I should mention that my comments focus on the impact to mobile. HP talked about a lot of other things on the call, including enterprise, and their move towards a software and service-centric focus, but that is not the center of this commentarty.

Leo Apotheker, who has been at the helm of HP for the past nine months, talked about 4 factors driving the strategic direction of HP for the foreseeable future. Of those, the most important to Carrypad’s readers will be the way forward with PSG, within which exists both the hardware design teams and the software development teams for WebOS and its devices to-date. Apotheker indicated that he felt that PSG can compete and win in the PC and mobile marketplace. However, and this was iterated many times throughout the call, the HP TouchPad had failed to meet the sales projections of the executive staff. Financial metrics were set before the launch of the woeful device; yardsticks by which HP determined the success of the OS and the device, and then used to determine certain strategic decisions within the corporation.

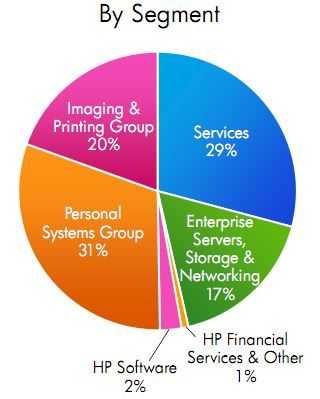

With the under-performance of the TouchPad’s launch, HP now intends to turn its emphasis towards cloud solutions for enterprise, encompassing software solutions and services. The company named a new VP for the Enterprise Services, which is the group that has evolved from the EDS purchase back in 2008. There is no question that HP is looking very intently at making themselves an enterprise-only solution provider. When you look at the financials, the reasons behind this may not immediately jump out at you. The chart below from the Quarterly Earnings Statement shows that the PSG accounted for nearly one-thrid of the company’s revenue.

And while HP still holds the lead stake in market share percentage in the personal computer market sector, financials at the next level of detail reveal what has created a concern for Apotheker and his staff. The PSG was 3% off its mark from a year ago in revenue and showed no growth in total units year-over year. Additionally the division took in 4% less revenue in notebook sales, desktop revenue is down 4%, and consumer client revenue is down 17%. Now, some of these numbers may not seem like they should cause that much concern. However, and this is only my speculation, if HP believes that tablets and smartphones will be a growth product sector, and that notebook and desktop PC sales will continue to decline, and HP is looking at its most recent product launches in the mobile category… you might start to see reasons to be concerned.

You could even interpret some of Apotheker’s statements as equating to just that. He and HP’s CFO, Catherine Lesjak, spoke several times about concern over the “velocity of change in the personal computing marketplace”. Apotheker stated that the company had assessed that the impact of the Tablet on personal computer sales was a very real threat. When considered in conjunction with the poor initial sales of the TouchPad, the various factors combined to lead them to consider restructuring into a new HP that may or may not include the PSG, and therefore WebOS.

I have seen all sorts of hyperbolic headlines around the web saying that HP is selling off its personal computing business and that, at least as of today, is simply not true. The executive staff of HP have a 12 to 18 month outlook as to what may become of the PSG. Another important tidbit, which Apotheker said himself during the Q&A following the formal presentation, is that a possible outcome of the PSG assessment is that the division may remain a part of HP proper with no change in the corporate structure. I believe that other things would still change, like strategic focus, design approaches, and so forth.

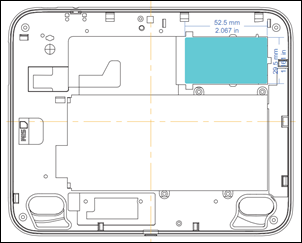

Seven-inch ‘HP Touchpad Go’ Passes Through FCC – Likely Launching This Month

Posted on 11 August 2011

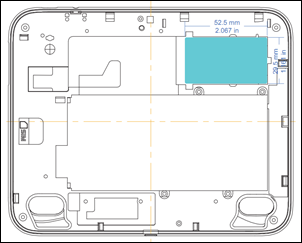

At the end of June, we covered a rumor of a 7-inch TouchPad and now we’ve got information to corroborate that rumor, thanks to the FCC.

At the end of June, we covered a rumor of a 7-inch TouchPad and now we’ve got information to corroborate that rumor, thanks to the FCC.

CENS.com had released a press release which included this statement:

As the world`s largest PC brand, HP is now in the tablet PC arena after introducing the 9.7-inch Touch Pad, has ordered from a supplier for 400,000 to 450,000 Touch Pad tablet PCs per month, and will sometime in August launch seven-inch tablet PCs. Inventec will supply HP these two tablet PC models.

The key here is the fact that Inventec is pointed to as the supplier of the device. Thanks to the FCC, we can see that the label location diagram bears the Inventec name. This gives more credibility to the statement above, and it is safe to say that the proposed August launch is likely to be accurate.

The 7-inch device that was once codenamed ‘Opal’ has been officially dubbed the TouchPad Go, and will come in 16GB/32GB variants, as well as 3G and 4G.

The label diagram indicates that 4G is HSPA+ which rules out Verizon, but there’s also a label that simply specifies ‘3G’ and doesn’t detail whether it’s HSPA or EV-DO, so Verizon and other CDMA carriers may or may not end up with the TouchPad Go. It’s safe to assume that the HSPA+ variant will find its way to AT&T, given that the 4G version of the 10 inch TouchPad already calls AT&T, home.

The label diagram indicates that 4G is HSPA+ which rules out Verizon, but there’s also a label that simply specifies ‘3G’ and doesn’t detail whether it’s HSPA or EV-DO, so Verizon and other CDMA carriers may or may not end up with the TouchPad Go. It’s safe to assume that the HSPA+ variant will find its way to AT&T, given that the 4G version of the 10 inch TouchPad already calls AT&T, home.

There’s a high probability that the TouchPad Go 4G will be using the dual-core 1.5GHz Qualcomm Snapdragon MSM8060, just as the TouchPad 4G is, but it isn’t clear whether or not there will be a CPU speed divide like we currently see between the TouchPad and the TouchPad 4G.

The TouchPad (WiFi-only) hit the market with the APQ8060 (a WiFi-only version of the MSM8060). HP clocked the APQ8060 to 1.2GHz for the WiFi-only TouchPad. The TouchPad 4G, which was announced shortly thereafter, uses the MSM8060, but HP decided to clock it to its full 1.5GHz.

I don’t exactly understand HP’s reason for having these two slightly different speeds, but if they feel there’s a need for it, we might see the same pattern come to the TouchPad Go, which would mean a 1.2GHz WiFi-only version while the 4G version would be clocked to 1.5GHz. That, or perhaps HP will just decide to release a software update to clock the WiFi-only TouchPad up to 1.5GHz to match the rest of the devices.

The labels found in the FCC documents list ‘1.5G’ across all variants; it’s likely (but not certain) that this means 1.5Ghz as opposed to ‘generation 1.5’.

Source: Electronista, FCC

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

|